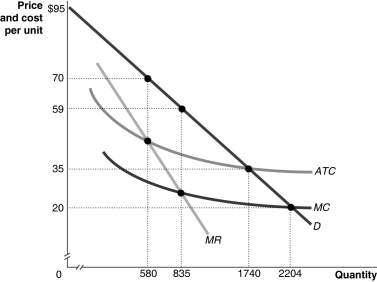

Figure 15-10

-Refer to Figure 15-10 to answer the following questions.

a.What quantity will this monopoly produce and what price will it charge?

b.Suppose the monopoly is regulated.If the regulatory agency wants to achieve economic efficiency,what price should it require the monopoly to charge?

c.To achieve economic efficiency,what quantity will the regulated monopoly produce?

d.Will the regulated monopoly make a profit if it charges the price that will achieve economic efficiency?

e.Suppose the government decides to regulate the monopoly by imposing a price ceiling of $35.What quantity will the monopoly produce and what price will the monopoly charge?

f.With the price ceiling of $35,what profit will the monopoly earn?

Definitions:

Internal Rate

Internal rate usually refers to the internal rate of return (IRR), a financial metric used to assess the profitability of investments by calculating the interest rate that makes the net present value (NPV) of all cash flows from a particular project or investment equal to zero.

Accept

In financial terms, it often refers to a bank's agreement to honor a draft or other financial instrument payable at a future date.

Net Present Value

The difference between the present value of cash inflows and outflows over a period of time, used in capital budgeting to assess profitability of investments.

Initial Investment

The amount of money used to start a new venture, purchase an asset, or stock in a portfolio, serving as the foundation for future financial performance and returns.

Q17: There is much evidence to suggest that

Q26: Refer to Table 16-2.What are the total

Q47: In perfect competition<br>A) the market demand curve

Q49: Refer to Table 14-3.Is there a dominant

Q53: Which of the following is the best

Q68: Consider the following characteristics: <br>a.a market structure

Q114: Assume that two interior design companies,Alistair and

Q123: Compared to monopoly pricing,an optimal two-part tariff<br>A)

Q146: Refer to Figure 11-2.The curve labeled "E"

Q150: Refer to Figure 12-10.Consider a typical firm