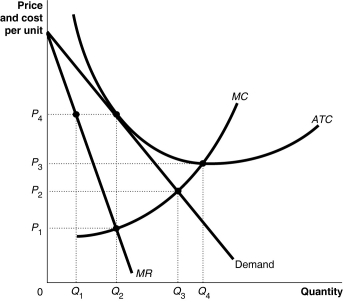

Figure 13-6

-Refer to Figure 13-6.What is the amount of excess capacity?

Definitions:

Double Taxation

The imposition of taxes on the same income, asset, or financial transaction at two levels, such as corporate profits taxed at both the corporate and individual shareholder levels.

Public Corporations

Corporations owned by the government and operated for the public benefit, often subject to different regulations than private corporations.

Unlimited Liability

A legal structure where business owners are personally responsible for all of the company's debts, putting personal assets at risk.

Corporation

A legal entity that is separate and distinct from its owners, providing them with limited liability protection, and has the ability to enter into contracts, own assets, and pay taxes.

Q16: Firms pay famous individuals to endorse their

Q49: Unlike a perfectly competitive firm,for a monopolistically

Q52: Consider a downward-sloping demand curve.When the price

Q57: Assuming zero transaction cost,if your local grocer

Q73: When a monopolistically competitive firm cuts its

Q89: Suppose two firms in a duopoly implicitly

Q114: If,when a firm doubles all its inputs,its

Q130: The town of Saddle Peak has a

Q137: A Herfindahl-Hirschman Index is calculated by<br>A) summing

Q142: If,for a perfectly competitive firm,price exceeds the