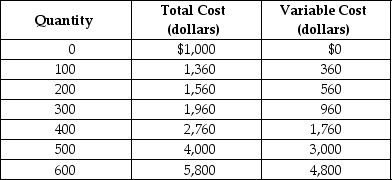

Table 12-1

Table 12-1 shows the short-run cost data of a perfectly competitive firm that produces plastic camera cases.Assume that output can only be increased in batches of 100 units.

-Refer to Table 12-1.If the market price of each camera case is $8, what is the profit-maximizing quantity?

Definitions:

Tax Rates

The percentage at which an individual or corporation is taxed by the government.

Macroeconomic Theories

Encompass the broad concepts and frameworks used to understand, analyze, and assess the overall behavior of a nation's economy, including factors like inflation, unemployment, and economic growth.

Laffer Curve

A theoretical representation of the relationship between tax rates and tax revenue, suggesting an optimal tax rate for maximizing revenue.

Supply-Side Economics

Main tenets: economic role of federal government is too large; high tax rates and government regulations hurt the incentives of individuals and business firms to produce goods and services.

Q29: Refer to Figure 15-2.Suppose the monopolist represented

Q68: Refer to Figure 10-5.A change in the

Q74: If an industry is made up of

Q78: A perfectly competitive firm breaks even at

Q92: A firm that is first to the

Q98: In the short run,a firm that incurs

Q116: Refer to Figure 10-6.Suppose the price of

Q120: Most film processing companies have a policy

Q134: Which of the following is a disadvantage

Q140: Economists Robert Jensen and Nolan Miller reasoned