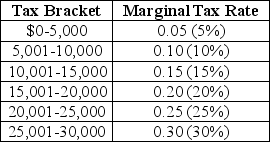

Last year,Anthony Millanti earned exactly $30,000 of taxable income.Assume that the income tax system used to determine Anthony's tax liability is progressive.The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a. Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket,and the total tax he owes the government.(Assume that there are no allowable tax deductions,tax credits,personal exemptions or any other deductions that Anthony can use to reduce his tax liability).

b.Determine Anthony's average tax rate.

Definitions:

HR Metrics

Quantifiable measures used to track and assess the efficiency and effectiveness of HR practices within an organization.

Performance Indicators

Quantifiable metrics used to gauge the effectiveness or success of an activity, process, or organization.

Big Data

Large and complex data sets that require advanced processing systems for analysis, offering insights for decision-making and strategic planning across various fields.

Data Analysis

The process of inspecting, cleansing, transforming, and modeling data with the goal of discovering useful information, informing conclusions, and supporting decision-making.

Q26: Refer to the Article Summary.If more European

Q27: The government of Silverado raises revenue to

Q87: Studies by the U.S.Census Bureau have shown

Q144: Refer to Table 2-5.The Shellfish Shack produces

Q182: Refer to Figure 3-8.The graph in this

Q228: The marginal product of labor is<br>A) the

Q249: In a study conducted by Marianne Bertrand

Q257: What is the voting paradox?<br>A) the observation

Q268: The Equal Pay Act of 1963 requires

Q273: Suppose a competitive firm is paying a