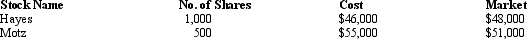

Barkely Corporation has invested in the stock of two other corporations,Hayes Corporation and Motz Corporation.Barkely does not own a controlling interest or exercise significant influence over either corporation.Barkely's accountant is preparing financial statements and has compiled the following information:  What should be the balance in the Allowance to Adjust Long-Term Investments to Market account,based on the above information?

What should be the balance in the Allowance to Adjust Long-Term Investments to Market account,based on the above information?

Definitions:

Systematic Risk

The risk inherent to the entire market or market segment, not reducible through diversification.

Security Market Line

A line on a chart that displays the relationship between risk and the expected return of the market portfolio. It serves as a graphical representation of the Capital Asset Pricing Model (CAPM).

Beta Coefficient

A framework for quantifying the variability, or orderly risk, of a security or investment compilation when juxtaposed with the general market.

Risk Premium

The additional return an investor demands for choosing a risky investment over a risk-free option, serving as compensation for the additional risk.

Q13: Klondike and Leola own 10,000 shares of

Q17: Tiny is an accountant. Tiny's violation of

Q39: The Federal Reserve Board is an example

Q51: In accounting,to recognize means to record a

Q60: Each partner is personally liable only for

Q72: Dividends of a corporation are declared by

Q81: Trading securities appear as current assets on

Q96: Carrying out professional responsibilities with competence and

Q116: In July,a company pays three years' insurance

Q164: If an adjusting entry is not made