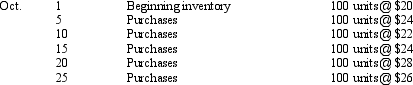

Graczyk Company uses a periodic inventory system.During October,it sold 360 units of Product Z.Its beginning inventory and purchases during the month were as follows:

Compute the cost of goods sold under each of three methods: (a)average-cost, (b)LIFO,and (c)FIFO.(Show your work. )

Compute the cost of goods sold under each of three methods: (a)average-cost, (b)LIFO,and (c)FIFO.(Show your work. )

Definitions:

Cash Collections

The process of receiving payment from customers for goods or services provided, impacting the company's cash flow positively.

Manufacturing Costs

Expenses directly incurred in the production of goods, including raw materials, labor, and overhead costs.

Insurance Expense

Insurance expense is the cost incurred by a business for various types of insurance coverages to protect against risks and potential liabilities.

Property Tax

Taxes paid by property owners, based on the value of their property, to fund municipal services such as schooling, road maintenance, and public safety.

Q4: Using the following amounts taken from the

Q15: A periodic inventory system is used;ending inventory

Q29: Which of the following would be deducted

Q90: The profit margin and asset turnover ratios

Q90: Which of the following items is not

Q98: The faster goods are sold and collection

Q101: During periods of consistently falling prices,the FIFO

Q113: When applying the retail method,which of the

Q120: Ending merchandise inventory is not included in

Q220: Free cash flow is a good measure