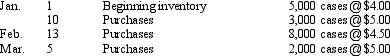

Atwood Company uses a periodic inventory system.During the first quarter of 2014,it sold 12,000 cases of Product A for $120,000.Facts related to its beginning inventory and purchases are as follows:

For the quarter ended March 31,2014,compute the ending inventory,cost of goods sold,and gross margin under three methods: (a)average-cost, (b)FIFO,and (c)LIFO.(Show your work. )

For the quarter ended March 31,2014,compute the ending inventory,cost of goods sold,and gross margin under three methods: (a)average-cost, (b)FIFO,and (c)LIFO.(Show your work. )

Definitions:

Variable Operating Costs

Costs that fluctuate with the level of production or sales volume, such as materials and labor.

Labor Hour

A measurement of work output or productivity calculated as the amount of labor input in terms of hours expended.

Time and Materials Pricing

A pricing strategy where the customer pays for the time spent on a project and the materials used, commonly used in service and contracting industries.

Variable Costs

Expenses that fluctuate in direct proportion to changes in the level of business activity or production volume, such as raw materials and direct labor.

Q23: Product warranties are an expense of the

Q29: Why is the LIFO cost flow assumption

Q48: An accountant is responsible for the following

Q59: What is a LIFO liquidation,and what is

Q83: The use of prenumbered documents is important

Q100: When a petty cash fund is replenished,the

Q128: Which of the following depreciation methods is

Q129: The total amount of working capital is<br>A)($30,000.

Q132: If cost of goods sold is understated

Q187: Book value is another term for carrying