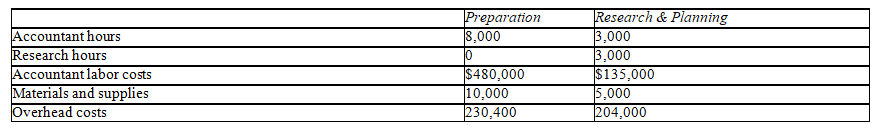

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns.The firm has five accountants and five researchers,and it uses job order costing to determine the cost of each client's return.The firm is divided into two departments: (1)Preparation and (2)Research & Planning.Each department has its own overhead application rate.The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours.The following is the company's estimates for the current year's operations.

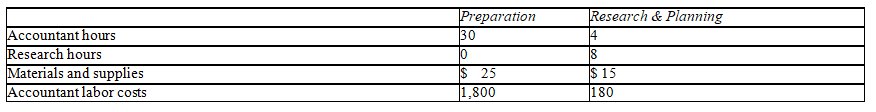

Client No.2006-713 was completed during April of the current year and incurred the following costs and hours:

a.Compute the overhead rates to be used by both departments.

b.Determine the cost of Client No.2006-713,by department and in total.

Definitions:

Swaps

Financial derivatives where two parties exchange financial instruments or cash flows.

Gilts

Government bonds issued by the United Kingdom, considered low-risk investments since they are backed by the British government.

Unbiased Forward Rates

Interest rates or currency exchange rates that are equal to the expected future spot rates, implying no arbitrage opportunities.

Exchange Rate

The exchange rate reflecting the value of one currency compared to another.

Q15: Units completed and transferred out of the

Q21: Service organizations use unit costs of services

Q36: The sale of plant assets and the

Q51: The selling and administrative expense budget is

Q64: How do managers measure an activity's performance?

Q77: Dividend yield is a liquidity ratio.

Q77: The number of equivalent units produced in

Q94: Which of the following equations represents a

Q97: A general rule in choosing among alternative

Q103: Determining the percentage change in an item