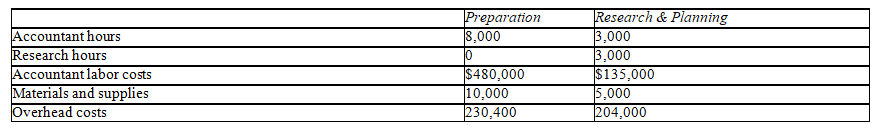

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns.The firm has five accountants and five researchers,and it uses job order costing to determine the cost of each client's return.The firm is divided into two departments: (1)Preparation and (2)Research & Planning.Each department has its own overhead application rate.The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours.The following is the company's estimates for the current year's operations.

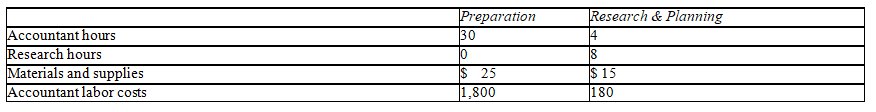

Client No.2006-713 was completed during April of the current year and incurred the following costs and hours:

a.Compute the overhead rates to be used by both departments.

b.Determine the cost of Client No.2006-713,by department and in total.

Definitions:

Q16: The cash flow yield equals net cash

Q25: Which of the following should not be

Q58: Contrast the circumstances where horizontal analysis would

Q58: If the difference between overhead applied and

Q60: You have been invited to address the

Q100: The average costing method matches cost flow

Q107: Breakeven analysis helps in finding the level

Q136: Inventoriable cost is a synonym of product

Q137: Liquidity ratios are an indication of a

Q189: Non-value-adding costs increase the cost of a