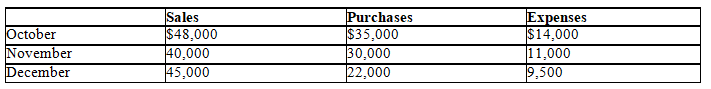

Great Lake Corporation wishes to prepare a cash budget for November 2014.Sales,purchases,and expenses for October (actual) and November and December (estimated) are as follows:  Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Purchases: The company pays 60 percent of purchases in the month of purchase and the balance in the following month.The company is allowed an average discount of 1 percent on payments made in the month of purchase.

Expenses: The monthly expenses for November include charges for depreciation amounting to $1,000 and $100 of prepaid expenses,which will expire.All other expenses are paid as incurred.

Other: On September 1,2014,a new machine was purchased for $5,000.A down payment of $500 was made,and it was agreed that the balance would be paid in equal installments in the following three months.

-The cash payments in November for expenses of Great Lake are expected to be

Definitions:

Organizational Leadership

The process of guiding and managing the efforts of members within an organization towards achieving the organization's objectives through strategic decision-making and effective communication.

Reward Systems

Mechanisms within organizations designed to motivate and incentivize employees by recognizing their contributions and achievements.

Team Cohesiveness

The extent to which team members are attracted to the team and motivated to remain part of it, leading to better teamwork, communication, and overall team performance.

Brooks's Law

A principle stating that adding more manpower to a late software project only makes it later.

Q12: The total costs that will be transferred

Q33: Crazy Cars Corporation's flexible budget for 30,000

Q36: Magic Wizard Inc.uses the FIFO costing method

Q56: When the FIFO costing method is used

Q76: Using the above information for Lopez,the net

Q76: What will be the value for utilities

Q84: Why is the residual value of equipment

Q91: The standard fixed overhead rate is usually

Q151: Plunda Co.is planning production for the coming

Q166: One of the assumptions of CVP analysis