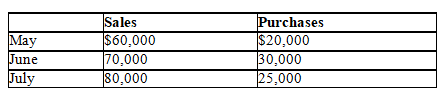

The following information is available from the controller's records for Penelope Ltd.:

All sales are on credit.Records show that 80 percent of the customers pay during the month of the sale,15 percent pay the month after the sale,and the remaining 5 percent pay the second month after the sale.Purchases are all paid the following month at a 1 percent discount.Cash disbursements for operating expenses in July were $8,000.

Prepare a cash budget for July.

Definitions:

Taxes

Compulsory financial charges or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund various public expenditures.

Consumers

Individuals or households that use goods and services generated within the economy.

Sellers

Individuals or entities that offer products, goods, or services for sale to buyers.

Tax Increase

The act of raising the amount of money government collects from taxes, often to fund public services or reduce budget deficits.

Q5: Which of the following costs is a

Q7: Qualitative factors are considered in the evaluation

Q15: The most commonly used methods in evaluation

Q31: Perry Company has a tax rate of

Q59: Which of the following statements is not

Q65: The performance of Steve,the manager of Center

Q79: A flexible budget is derived by dividing

Q99: The breakeven point is<br>A)where fixed and variable

Q99: Resser Corporation manufactures serving trays and utensils

Q119: Using the high-low method and the information