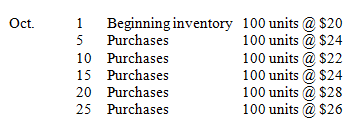

Graczyk Company uses a periodic inventory system.During October,it sold 360 units of Product Z.Its beginning inventory and purchases during the month were as follows: Compute the cost of goods sold under each of three methods: (a)average-cost, (b)LIFO,and (c)FIFO.(Show your work. )

Compute the cost of goods sold under each of three methods: (a)average-cost, (b)LIFO,and (c)FIFO.(Show your work. )

Definitions:

Health Care Prices

The cost associated with medical care, including services, procedures, and medications, which can vary widely depending on location and providers.

Supply Of Physicians

The total number of practicing doctors available in a particular area or market.

Tax Subsidy

Financial assistance provided by the government through tax benefits, reducing the tax burden for certain activities or taxpayers.

Employer-Financed Health Insurance

A health coverage plan provided by an employer to their employees as part of the employment agreement and benefits package.

Q9: On a bank reconciliation,interest income would be

Q13: Assuming that a periodic inventory system is

Q32: Under rising prices,why will the FIFO method

Q45: Direct materials and direct labor are components

Q87: Assume that on December 1,a $6,000,90-day,10 percent

Q90: Which of the following is not an

Q103: The convention of consistency refers to consistent

Q120: Merchandising companies do not need as good

Q168: When the periodic inventory system is used,a

Q171: Copper,Inc.purchased merchandise worth $1,800 on credit,terms n/30