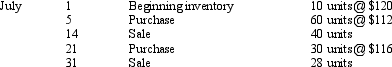

Use this inventory information for the month of July to answer the following question.

-Assuming that a periodic inventory system is used,what is cost of goods sold on a FIFO basis?

Definitions:

Federal Income Tax

An annual financial obligation placed on individuals, companies, trusts, and various legal entities by the central government.

State Income Tax

A tax imposed by a state on the income earned by individuals, corporations, or other legal entities within that state.

Federal Income Tax

The tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Allowances

A revision of the definition referring to sums of money set aside or given for a specific purpose, such as deductions from taxable income to account for certain expenses.

Q9: On a multistep income statement,other revenues and

Q13: Which of the following is necessary for

Q13: Which of the following documents would not

Q22: The work sheet is prepared after the

Q40: Closing entries are made<br>A)to clear revenue and

Q81: A petty cash fund is established for

Q97: Although a garbage can that costs $25

Q98: Which of the following is a quality

Q156: Which of the following accounts is a

Q158: An American company makes a credit sale