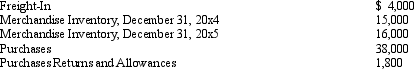

Given the following information,prepare in good form the cost of goods sold section of an income statement for 20x5.

Definitions:

Synthetic Lease

A financing arrangement that classifies as an operating lease for accounting purposes but as a financing purchase for tax purposes, often used in real estate and equipment leases.

Tax-Oriented Lease

A leasing agreement structured to maximize tax benefits for the lessor, often by passing on tax advantages to the lessee in the form of lower lease payments.

Long-Term Commitment

A pledge or engagement to something for an extended period, often seen in investments or strategic plans.

International Accounting Standards

A set of accounting standards stating how particular types of transactions and other events should be reported in financial statements, established by the International Accounting Standards Board.

Q37: The amount of net income (or net

Q39: The LIFO method agrees with the actual

Q66: Which of the following is not considered

Q71: Assume that during the physical count of

Q79: It is best that the receiving department

Q126: Wolf Equipment uses a perpetual inventory method.Discuss

Q131: A merchandiser will earn an operating income

Q158: During the closing process,expenses are transferred to

Q163: Answer the following questions.(Show your work. )<br>a.A

Q175: A retail operation would not have to