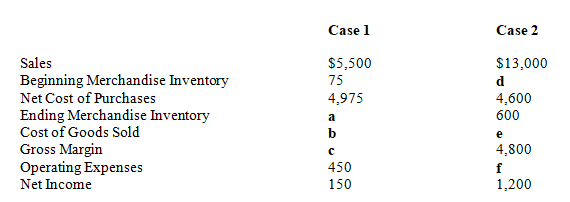

Compute the dollar amount of the items indicated by letters a through f in the table below.

Definitions:

Manufacturing Overhead

All manufacturing costs that are not directly related to the production of a product, including indirect materials, indirect labor, and other indirect costs.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead to individual products or jobs, based on a certain activity, such as direct labor hours or machine hours.

Direct Labor-Hours

The total time spent by workers directly involved in the manufacturing process.

Unit Product Cost

The total cost (direct materials, direct labor, and overhead) to produce a single unit of a product.

Q6: Financial statements are often audited by management

Q21: Which of the following items is not

Q30: The matching rule is most closely related

Q34: The convention of consistency pertains to the

Q55: An adjusting entry made to record salaries

Q56: Liberty Industries purchased merchandise worth $1,800 on

Q108: Consistency in accounting means that a company

Q142: Which of the following inventory methods when

Q157: Which of the following adjustments most likely

Q172: Under the perpetual inventory system,the return of