Management of Moore City Trust is in the process of evaluating the purchase of a new check sorting machine.The model under review will cost $44,000 and will require installation costs of $5,000.Similar machines have a ten-year life,and management has estimated that this sorter will have a residual value of $2,500 at the end of its life.Annual cost savings to be generated by the sorter will average $9,500 over the ten-year period.Management's minimum desired before-tax rate of return is 14 percent.

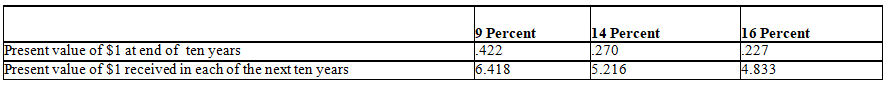

Present value multipliers:

a.Using before-tax information and the net present value method to evaluate this capital investment,determine whether the company should purchase the check sorting machine.Support your answer.

a.Using before-tax information and the net present value method to evaluate this capital investment,determine whether the company should purchase the check sorting machine.Support your answer.

b.If management had decided on a minimum desired before-tax rate of return of 16 percent,should the check sorting machine be purchased? Show all computations to support your answer.Round answers to nearest dollar.

Definitions:

Independent Variables

The factors that are manipulated or varied by researchers in an experiment to determine their effect on the dependent variable.

Dependent Variable

In experimental research, the variable that is being tested and measured, expected to change as a result of manipulations to the independent variable.

Fear Arousal

A psychological response to a threat that increases alertness or anxiety, often studied in the context of behavior change interventions.

Attitude Change

A psychological process where an individual’s feelings, beliefs, or positions on an issue are modified through persuasion, education, or experience.

Q30: Although expensive to install and maintain,a standard

Q43: Which of the following is not an

Q49: Using the above information provided for Underfoot

Q60: Adjusting entries affect cash flows in the

Q61: A flexible budget is derived by dividing

Q62: An organization's theoretical operating capacity is the

Q71: What will be the value for factory

Q109: A combined set of operational budgets and

Q119: Given the following cost and activity observations

Q153: When using the accounting rate-of-return method,the net