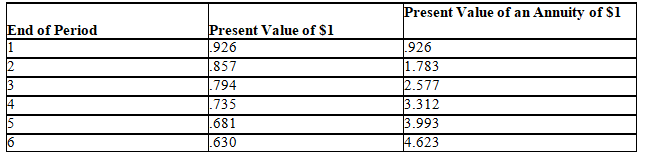

You are given the following present value factors at 8 percent,the Tehachapi Glass Company's minimum desired rate of return:

The Tehachapi Glass Company is considering the replacement of a piece of equipment.The old machine has a carrying value of $800 and a remaining estimated life of five years,with no residual value at that time.Present residual value is $200.The new equipment will cost $1,200,including transportation and installation.It has an estimated life of five years,with no residual value then.Annual cash operating costs are $405 for the old machine and $165 for the new machine.Round answers to two decimal places.

a.Compute the present value of the operating cash outflows for the old machine.

b.Compute the present value of the operating cash outflows for the new machine.

c.Compute the present value of the cash operating savings if the new machine is purchased.

d.What is the net present value of the replacement alternative?

Definitions:

Independent

Not influenced or controlled by others in matters of opinion, conduct; not depending on another's authority.

Return on Assets

A financial ratio that shows the percentage of profit a company earns in relation to its overall resources (total assets).

Net Present Value

In capital budgeting, this refers to the variance between the current value of incoming cash and the current value of outgoing cash across a specific period, utilized to determine an investment's profit potential.

Present Value

The contemporary value of money expected to be received in the future or a flow of cash, discounted by a certain rate of return.

Q6: Standard costs for company products are typically

Q16: Myrid Inc.sells each crystal goblet that it

Q36: Doug Riley is the only accountant employed

Q42: Joan Miller owns an advertising agency.One of

Q67: As the staff accountant for Investment Center

Q68: If standard costing is not economically feasible

Q95: The direct materials price variance is the

Q125: Discuss the qualitative factors that should be

Q135: Which of the following items is used

Q176: The Cal-Fruit Company specializes in decorative fruit