Management of Moore City Trust is in the process of evaluating the purchase of a new check sorting machine.The model under review will cost $44,000 and will require installation costs of $5,000.Similar machines have a ten-year life,and management has estimated that this sorter will have a residual value of $2,500 at the end of its life.Annual cost savings to be generated by the sorter will average $9,500 over the ten-year period.Management's minimum desired before-tax rate of return is 14 percent.

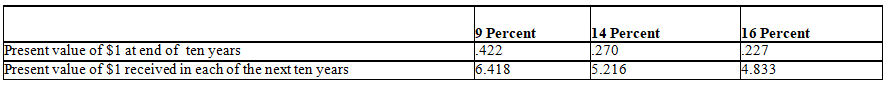

Present value multipliers:

a.Using before-tax information and the net present value method to evaluate this capital investment,determine whether the company should purchase the check sorting machine.Support your answer.

a.Using before-tax information and the net present value method to evaluate this capital investment,determine whether the company should purchase the check sorting machine.Support your answer.

b.If management had decided on a minimum desired before-tax rate of return of 16 percent,should the check sorting machine be purchased? Show all computations to support your answer.Round answers to nearest dollar.

Definitions:

Customer Service

The support companies offer to their customers before, during, and after purchasing or using their products or services.

Exclusive Distribution

Distribution strategy involving limited market coverage by a single retailer or wholesaler in a specific geographical territory.

Luxury Automobiles

High-end vehicles that offer superior comfort, performance, and amenities, often characterized by their higher price points and status symbol.

Franchised Specialty Goods

Retail products sold through outlets operating under a franchise agreement, often focusing on a niche market.

Q39: Practical capacity and engineering capacity are synonymous

Q40: Financial budgets include<br>A)pro forma financial statements,a sales

Q42: In estimating cash receipts and cash payments

Q47: The direct labor rate variance is the

Q47: An important purpose of closing entries is

Q57: The use of quantitative tools to gauge

Q64: Why is the residual value of equipment

Q79: What is the business purpose of the

Q89: Use the numbers corresponding to the accounts

Q143: Which of the following transactions is most