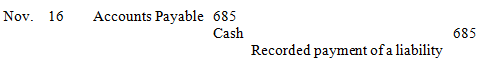

Use this journal entry to answer the following question. Explain how the above journal entry relates to the measurement issues of (a)recognition, (b)valuation,and (c)classification.

Explain how the above journal entry relates to the measurement issues of (a)recognition, (b)valuation,and (c)classification.

Definitions:

Tax-Exempt

A status that exempts an individual or entity from having to pay federal, state, or local taxes.

Private Activities

Activities undertaken by private individuals or entities as opposed to those initiated or conducted by governmental bodies or public institutions.

Convention Centers

Large facilities designed to host conferences, exhibitions, and large events, often featuring a variety of spaces including auditoriums, exhibit halls, and meeting rooms.

Cash-Basis Taxpayer

A Cash-Basis Taxpayer is an individual or business that reports income and deductions in the year that they are actually received or paid, as opposed to when they are earned or incurred.

Q7: When planning,managers allocate overhead costs using either

Q34: Because process costing is normally associated with

Q43: The traditional approach to applying overhead costs

Q46: Which of the following is true of

Q48: Which of the following statements is true

Q66: The Work in Process Inventory account in

Q90: Overhead costs are<br>A)not allocated to the Work

Q92: Job order costing is used by companies

Q151: Management accounting formats are identical for all

Q192: Conversion costs consist of<br>A)direct materials costs and