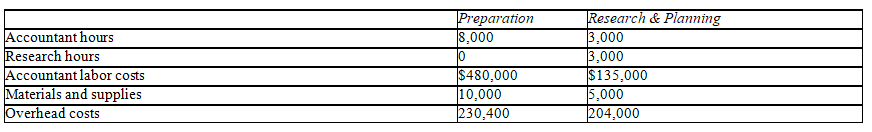

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns.The firm has five accountants and five researchers,and it uses job order costing to determine the cost of each client's return.The firm is divided into two departments: (1)Preparation and (2)Research & Planning.Each department has its own overhead application rate.The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours.The following is the company's estimates for the current year's operations.

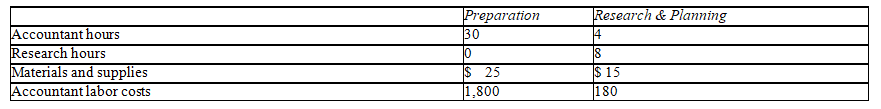

Client No.2006-713 was completed during April of the current year and incurred the following costs and hours:

a.Compute the overhead rates to be used by both departments.

b.Determine the cost of Client No.2006-713,by department and in total.

Definitions:

Direct Exporting

A method of entering a foreign market by selling goods directly to customers in another country, bypassing any intermediaries.

Back Translation

The process where a text is translated from one language to another and then translated back to the original language by a different translator to check for accuracy.

Market Entry Strategy

The strategic approach to providing products or services to a new audience and distributing them within that market.

Profit Potential

The capacity of a business or investment to generate earnings over time.

Q1: Which of the following activities would be

Q35: Practitioners of management accounting and financial management

Q53: Per the Sarbanes-Oxley Act of 2002,public corporations

Q69: Lincoln Company engaged in this transaction: Purchased

Q78: The cost of direct materials used in

Q78: In a common-size income statement,net sales is

Q80: In a trial balance,all debits are listed

Q92: Job order costing is used by companies

Q114: How are cash equivalents treated on a

Q148: A limitation of using industry norms in