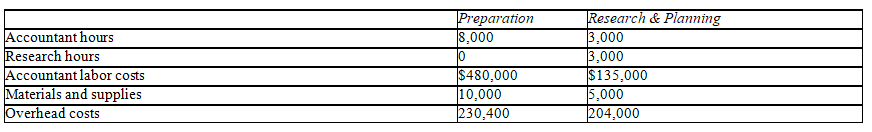

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns.The firm has five accountants and five researchers,and it uses job order costing to determine the cost of each client's return.The firm is divided into two departments: (1)Preparation and (2)Research & Planning.Each department has its own overhead application rate.The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours.The following is the company's estimates for the current year's operations.

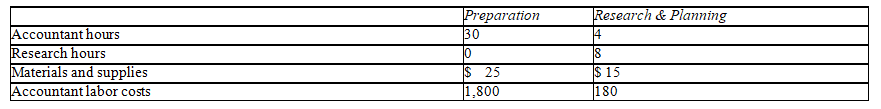

Client No.2006-713 was completed during April of the current year and incurred the following costs and hours:

a.Compute the overhead rates to be used by both departments.

b.Determine the cost of Client No.2006-713,by department and in total.

Definitions:

Average-Variable-Cost Curve

A graphical representation showing how the average variable cost of production changes as the quantity of output is altered.

Average Variable Cost

The sum of all costs that vary with output levels, divided by the total quantity of produced output.

Average Total Cost

The aggregate expense of manufacturing (comprising both fixed and variable expenditures) divided by the overall amount produced.

Marginal Cost

The incremental cost of producing an extra unit of a good or service.

Q18: Which of the following costing methods combines

Q18: In a common-size balance sheet for a

Q22: After each of the following transactions is

Q48: When presenting decreases in long-term investments in

Q49: When preparing a statement of cash flows

Q59: The normal balance of an account is

Q113: Total variable costs remain constant within a

Q115: Copper Company began operations in April and

Q126: Assume that you have calculated a direct

Q148: A limitation of using industry norms in