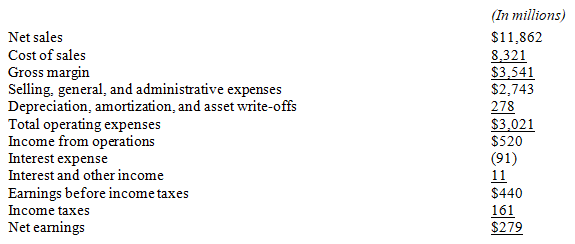

Using the following information from an annual report,prepare a vertical analysis of the consolidated statement of earnings for the fiscal year ended June 30,20x5.(Round percentage answers to one decimal place. )

Definitions:

SML

Security Market Line, a graphical representation that shows the expected return of a security or portfolio as a function of its beta (systematic risk).

Expected Total Return

The sum of income and capital appreciation that an investment is anticipated to earn over a specific period.

Constant

A value that remains unchanged throughout the course of a calculation or process.

Expected Dividend

Expected Dividend is the forecasted payment of a portion of a company's earnings to its shareholders, typically expressed as an amount per share.

Q15: What is the predetermined overhead rate for

Q36: Which of the following is a variable

Q74: The price/earnings (P/E)ratio is an indication of

Q77: Describe how the process costing information is

Q102: A quick ratio that is about equal

Q113: Which of the following could be described

Q136: Financial statement analysis is used to show

Q170: On December 31,20x5,the balance sheet of the

Q171: The two primary types of cost behavior

Q176: Managerial accounting information is primarily used by<br>A)lenders.<br>B)supply-chain