Jordan,Kyle,and Noah Have Equities in a Partnership of $100,000,$160,000,and $140,000,respectively,and

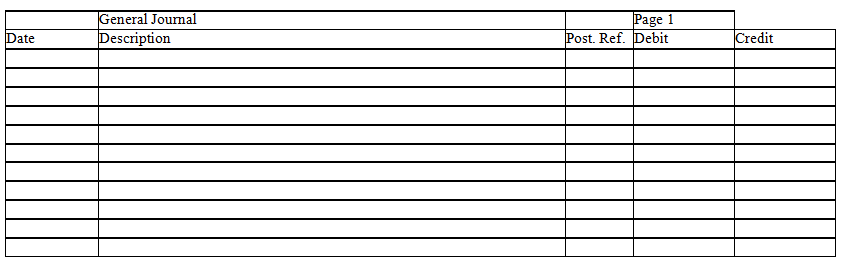

Jordan,Kyle,and Noah have equities in a partnership of $100,000,$160,000,and $140,000,respectively,and share income and losses in a ratio of 5:3:2,respectively.The partners have agreed to admit Billy to the partnership.Prepare entries in journal form without explanations to record the admission of Billy to the partnership under each of the following assumptions:

a.Billy invests $80,000 for a 25 percent interest,and a bonus is recorded for Billy.

b.Billy invests $160,000 for a one-fifth interest,and a bonus is recorded for the old partners.

Definitions:

Direct Method

A method of preparing the cash flow statement where actual cash flow information from the company's operations is used, as opposed to indirect method adjustments.

Operating Cash Receipts

Money received by a company from its operational activities, such as sales of goods or services.

Accumulated Depreciation

The total amount of depreciation expense recorded for an asset, reducing its book value over time.

Equipment Costing

The process of tracking and analyzing the costs associated with the purchase and maintenance of equipment.

Q2: If the amount of a liability cannot

Q17: Greco Co.issued ten-year term bonds on January

Q28: Each partner has a separate Capital,Withdrawals,and Income

Q41: A building was purchased for $250,000.It has

Q46: No entry is required on the date

Q101: How will the declaration and distribution of

Q113: Which of the following could be described

Q159: When common stock with a par value

Q178: The book value of one share of

Q191: Return on equity is measured in terms