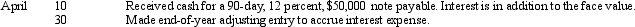

Use this information to answer the following question. The transactions below pertain to Dunhill Company,whose fiscal year ends April 30. The entry to record the April 10 transaction (amounts rounded) is:

The entry to record the April 10 transaction (amounts rounded) is:

Definitions:

Net Operating Income

Profit or loss from a company's operations after all operating expenses are subtracted from operating revenues, but before interest and taxes are deducted.

Variable Costing

Variable costing is an accounting method that only considers variable costs in the calculation of the cost of goods sold, excluding fixed costs.

Net Operating Income

Income derived from normal business operations after subtracting all operating expenses but before interest and taxes.

Absorption Costing

An accounting procedure that integrates all production-related costs, capturing direct material expenses, direct labor costs, and all overheads, variable and fixed, within the cost framework of a product.

Q4: Small expenditures for what ordinarily are considered

Q12: The purchase of equipment is an example

Q59: Which of the following items is not

Q85: Total payroll for a given week is

Q124: One argument in favor of accelerated depreciation

Q144: The following facts pertain to Quail Corporation:<br>

Q147: What would be the adjusting entry for

Q151: Marta Company had cash sales of $120,000

Q165: All of the following are needed for

Q213: The Equipment account would include all of