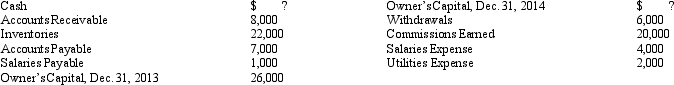

Use the following information to calculate at or for the year ended December 31,2014:

(a)net income, (b)owner's capital, (c)total assets,and (d)cash.

Definitions:

Overhead Rate

A measure used to allocate indirect costs to produced goods, calculated by dividing total overheads by an allocation base like labor hours or machine hours.

Direct Labor Cost

The cost of labor directly involved in the production process, excluding indirect expenses like maintenance.

Predetermined Overhead Rate

This rate is used to allocate overhead costs to products or services based on a specific formula, often involving direct labor hours or direct material costs, aiding in the budgeting and costing process.

Direct Labor Costs

The wages and related benefits paid to employees who are directly involved in the production of goods or the provision of services.

Q1: Theresa,a cash basis taxpayer,purchased a bond on

Q37: Because graduate teaching assistantships are awarded on

Q71: A positive free cash flow means that

Q99: In terms of revenue neutrality,comment on the

Q107: Which,if any,of the following taxes are proportional

Q115: What is goodwill and when may it

Q123: If an income tax return is not

Q124: Revenues have the effect of increasing owner's

Q151: Carrying value<br>A)equals cost minus accumulated depreciation.<br>B)equals cost

Q159: Under what circumstances is a contingent liability