In connection with facilitating the function of the IRS in the administration of the tax laws,comment on the utility of the following:

Definitions:

Income Tax Withholding

The process where employers deduct tax from employees' wages and directly pay it to the government.

Exemption

In taxation, an exemption is a monetary exclusion that can be applied to reduce taxable income, often granted by the government to reduce the tax burden for certain groups, circumstances, or types of income.

Qualifying Relative

A dependent for whom the taxpayer provides financial support and who meets certain IRS criteria for tax benefits.

Dependent Taxpayer Test

Criteria used to determine if a taxpayer can be claimed as a dependent on someone else's tax return, affecting exemptions and credits.

Q11: A tax cut enacted by Congress that

Q19: Explain the difference between tax avoidance and

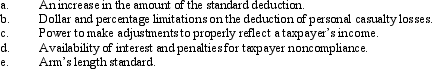

Q34: Which of the following might be motivation

Q41: A building was purchased for $250,000.It has

Q48: When an intangible asset becomes worthless,<br>A)it should

Q52: Heloise,age 74 and a widow,is claimed as

Q59: A hobby activity can result in all

Q89: All of the following are considered nonexchange

Q100: All of the following statements are true

Q161: All of the following statements about partnerships