Multiple Choice

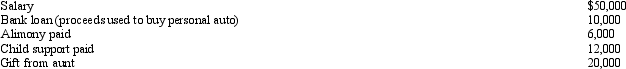

During 2010,Marvin had the following transactions:  Marvin's AGI is:

Marvin's AGI is:

Definitions:

Related Questions

Q2: The income of a sole proprietorship are

Q6: The following users of accounting information have

Q14: Kitty runs a brothel (illegal under state

Q44: A company's ability to attract and hold

Q45: Objectivity is the avoidance of all relationships

Q50: If an item such as property taxes

Q55: A large part of tax research involves

Q75: Are there any exceptions to the rule

Q99: In terms of revenue neutrality,comment on the

Q129: For purposes of the § 267 loss