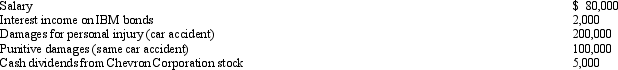

During 2010,Justin had the following transactions:  Justin's AGI is:

Justin's AGI is:

Definitions:

Profits and Losses

Refers to the financial gains and expenses incurred by a business, showing whether it has made a profit or suffered a loss over a particular period.

Capital Account Balances

The amounts in the accounts of partners or shareholders representing their contributions plus their share of net income or minus their share of losses.

Predistribution Plan

A strategic plan detailing how assets or profits will be allocated or distributed before the actual distribution takes place.

Profits and Losses

The financial gains or losses resulting from business operations after accounting for revenues and expenses.

Q24: An advantage to operating a business as

Q28: Tommy,an automobile mechanic employed by an auto

Q31: What are the tax problems associated with

Q49: The computer-based CPA examination has four sections

Q51: Before 1943,the U.S.Tax Court was called the

Q53: Turquoise Company purchased a life insurance policy

Q74: The Tax Relief Reconciliation Act of 2001

Q78: Which,if any,of the following is a deduction

Q112: Which,if any,of the following statements best describes

Q140: Theo owns a vacation home that is