Multiple Choice

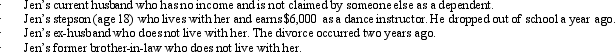

During 2010,Jen (age 66) furnished more than 50% of the support of the following persons:  Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Jen claim?

Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Jen claim?

Explain the role of timing in the effectiveness of conditioning.

Understand how classical conditioning theories are applied to modify behavior.

Identify factors that influence the strength and persistence of learned responses.

Analyze how classical conditioning principles can explain complex human behaviors and preferences.

Definitions:

Related Questions

Q3: Subchapter K refers to the "Partners and

Q5: A taxpayer who loses in a U.S.District

Q12: Which state is located in the jurisdiction

Q15: When separate income tax returns are filed

Q51: Susan purchased an annuity for $120,000.She is

Q88: Ed died while employed by Violet Company.His

Q90: Criminal penalties can be imposed on those

Q111: Chin Company's owner's equity equals one-third of

Q122: The IRS is required to redetermine the

Q126: Camille,a calendar year taxpayer,rented a building from