Multiple Choice

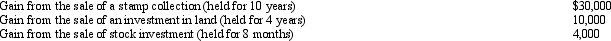

Perry is in the 33% tax bracket.During 2010,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

Definitions:

Related Questions

Q2: The amount of an individual's salary withheld

Q15: Regarding proper ethical guidelines,which (if any)of the

Q43: Peggy is in the business of factoring

Q61: The earnings from a qualified state tuition

Q62: One way of stating the accounting equation

Q62: The pay-as-you-go feature of the Federal income

Q76: Red Corporation incurred a $12,000 bad debt

Q122: The IRS is required to redetermine the

Q139: In an office audit,the audit by the

Q148: Use the following information to calculate at