Essay

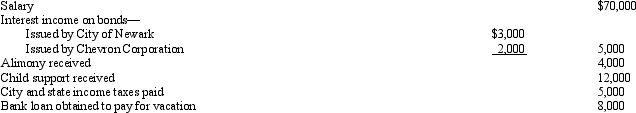

Emma had the following transactions during 2010:

What is Emma's AGI for 2010?

What is Emma's AGI for 2010?

Identify and explain the measures banks can take to manage reserve deficiencies and maintain regulatory compliance.

Understand the concept of the reserve ratio and its implications for banks.

Calculate the maximum new loans a bank can extend based on its excess reserves.

Analyze the impact of Federal Reserve actions on the money supply.

Definitions:

Related Questions

Q8: John had adjusted gross income of $60,000.During

Q10: In January 2010,Tammy purchased a bond due

Q12: The purchase of equipment is an example

Q16: Darryl,a cash basis taxpayer,gave 1,000 shares of

Q21: In early 2010,Ben sold a yacht,held for

Q26: What is independence,and why is it important

Q38: Employers can provide numerous benefits to their

Q43: What losses are deductible by an individual

Q46: A dependent cannot claim a personal exemption

Q125: Companies whose securities are sold to the