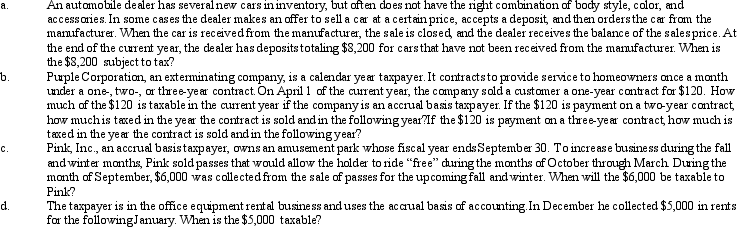

Determine the proper tax year for gross income inclusion in each of the following cases.

Definitions:

Net Profit Margin

A financial metric that shows the percentage of a company's revenue that remains as net income after operating expenses, interest, taxes, and preferred stock dividends have been deducted.

Management Efficiency

A measure of how effectively a business or organization's management team utilizes resources to achieve its goals.

Sales Dollar

A term representing the total dollar amount generated from sales transactions within a specific period.

Return on Assets

A financial ratio that measures the profitability of a company in relation to its total assets, indicating how efficiently the company is using its assets to generate profit.

Q16: Under MACRS,if the mid-quarter convention is applicable,all

Q32: Tim and Janet were divorced.Their only marital

Q37: A taxpayer who uses the automatic mileage

Q45: Tom loaned $20,000 to his controlled corporation.When

Q65: The amount of the addition to the

Q70: State income taxes generally can be characterized

Q71: Allowing a domestic production activities deduction for

Q112: For an expense to be deducted as

Q116: Which of the following taxpayers may file

Q117: Katelyn is divorced and maintains a household