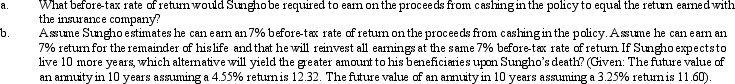

Sungho is married,files a joint return,and expects to be in the 35% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $50,000.He paid $20,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy,the insurance company will pay him $2,500 (5%)interest each year.Sungho thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Definitions:

Total Asset Turnover

A financial ratio that measures how efficiently a company uses its assets to generate sales by dividing net sales by total assets.

Total Debt Ratio

A financial ratio that compares a company's total liabilities to its total assets, indicating the proportion of a company's assets that are financed through debt.

Equity Multiplier

A financial leverage ratio that measures the portion of a company’s assets that are financed by its shareholders' equity.

Quick Ratio

A liquidity metric that measures a company's ability to meet its short-term obligations with its most liquid assets.

Q38: Land improvements are generally not eligible for

Q50: Since an abandoned spouse is considered to

Q63: Rustin bought used 7-year class property on

Q68: All listed property is subject to the

Q73: Are all personal expenses disallowed as deductions?

Q75: Under the alternative depreciation system (ADS),only the

Q76: Evaluate the following statements: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2201/.jpg" alt="Evaluate

Q88: Ed died while employed by Violet Company.His

Q116: Every year,Penguin Corporation gives each employee a

Q121: If the taxpayer's method of measuring income