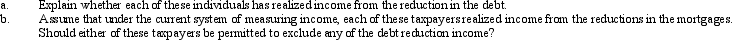

Sally and Ed each own property with a fair market value less than the amount of the outstanding mortgage on the property and also less than the original cost basis.They each were able to convince the mortgage holder to reduce the principal amount on the mortgage.Sally's mortgage is on her personal residence and Ed's mortgage is on rental property he owns.

Definitions:

Music

A form of art that uses sound organized in time, often combining vocal or instrumental sounds to produce harmony, rhythm, and expression of emotion.

Productivity

The efficiency at which goods or services are produced, often measured in terms of output per unit of input.

Experimental Group

A group of subjects in an experiment who are exposed to the variable under study.

Low-Fat Diet

A dietary approach that reduces the intake of fat, especially saturated fat and cholesterol, to promote heart health and possibly aid in weight loss.

Q4: When contributions are made to a traditional

Q18: Which of the following expenses,if any,qualify as

Q22: Investment-related expenses such as those related to

Q43: By itself,credit card receipts will constitute adequate

Q60: If personal casualty losses (after deducting the

Q63: Rustin bought used 7-year class property on

Q64: In the case of an office in

Q86: In a farming business,MACRS straight-line cost recovery

Q94: In order to protect against rent increases

Q130: In terms of the deductibility of military