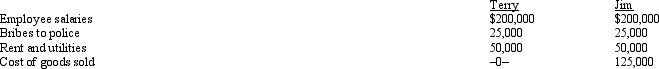

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Q13: Tonya is a cash basis taxpayer.In 2010,she

Q31: Hazel purchased a new business asset (five-year

Q40: A moving expense that is reimbursed by

Q49: The computer-based CPA examination has four sections

Q64: Doug purchased a new factory building on

Q83: In determining whether the support test is

Q86: If a vacation home is classified as

Q99: The plant union is negotiating with the

Q117: Katelyn is divorced and maintains a household

Q118: A statutory employee is a common law