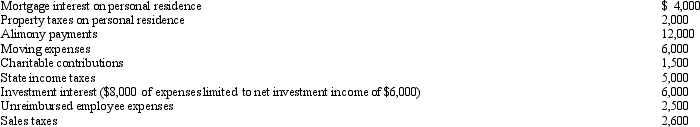

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Price

The amount of money required to purchase a good or service.

Marginal Costs

The change in total costs that arises when the quantity produced is incremented by one unit; it is the cost of producing one more unit of a good.

Potential Customers

Individuals or businesses that have not yet purchased but have shown interest in a company's products or services.

Expected Profit

The anticipated financial gain from an investment or business activity, considering possible risks and rewards.

Q12: On March 1,2010,Lana leases and places in

Q24: For tax purposes,married persons filing separate returns

Q28: Tan Company acquires a new machine (ten-year

Q36: What are the relevant factors to be

Q58: The reduced deduction election enables a taxpayer

Q61: Bonnie sells her personal use SUV for

Q67: Office Palace,Inc. ,leased an all-in-one printer to

Q72: Taxpayers may elect to use the straight-line

Q122: Dan is employed as an auditor by

Q125: Lloyd,a practicing CPA,pays tuition to attend law