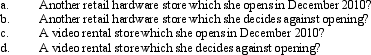

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2010 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2010 if the business is:

Definitions:

Brief Therapies

Therapeutic approaches designed to be short-term, focusing on specific problems and direct intervention.

Agreement

A mutual understanding or arrangement between two or more parties, often formalized by a contract or other legal document.

Duration

How long something lasts or is present.

Brief Therapy

A short-term psychological treatment aimed at addressing specific issues within a limited number of sessions.

Q4: On February 20,2009,Bill purchased stock in Pink

Q12: Pedro's child attends a school operated by

Q23: Thelma and Mitch were divorced.The couple had

Q41: Heather's interest and gains on investments for

Q73: George,a sculptor,has an elevator installed in his

Q81: The concept of depreciation is based on

Q87: A nonbusiness bad debt is a debt

Q103: If a married taxpayer is an active

Q112: For an expense to be deducted as

Q117: Arnold was employed during the first six