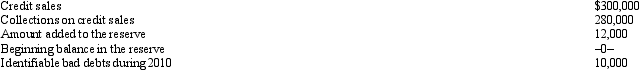

Swan,Inc.is an accrual basis taxpayer.Swan uses the aging approach to calculate the reserve for bad debts.During 2010,the following occur associated with bad debts.  The amount of the deduction for bad debt expense for Swan for 2010 is:

The amount of the deduction for bad debt expense for Swan for 2010 is:

Definitions:

Balance Per Books

The amount shown in a company's accounting records, as opposed to the actual cash balance or balance reported by a bank.

Cash Disbursement Transactions

Financial activities involving the payment of cash from a business to vendors, employees, or other entities.

Authorized

Refers to having official permission or approval, often in the context of legal or financial operations that have been ratified or sanctioned by a governing body or higher authority.

Q10: Fees for automobile inspections,automobile titles and registration,bridge

Q13: During 2010,Sam,a self-employed individual,paid the following amounts:

Q39: Logan,an 80-year-old widower,dies on January 2,2010.Even though

Q45: Wilma is a widow,age 80 and blind,who

Q87: Clark operates a gambling operation,which is an

Q96: Detroit Corporation sued Chicago Corporation for intentional

Q107: Emily is in the 35% marginal tax

Q125: Lloyd,a practicing CPA,pays tuition to attend law

Q129: For purposes of the § 267 loss

Q137: Rex,a cash basis calendar year taxpayer,runs a