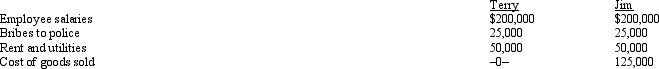

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

IRR

Internal Rate of Return, a financial metric used to evaluate the profitability of potential investments.

Depreciation

The systematic allocation of the cost of a tangible asset over its useful life, reflecting its consumption, wear and tear, or obsolescence.

Tax Impact

The effect of taxation on an individual's or company's financial situation, including tax liabilities and planning.

Incremental Cash Flow

Incremental cash flow is the additional cash flow a company receives from taking on a new project or investment, used to assess its profitability.

Q6: In terms of income tax consequences,abandoned spouses

Q10: Once the actual cost method is used,a

Q14: In the case of a zero interest

Q19: On a particular Saturday,Tom had planned to

Q30: Last year,Lucy purchased a $100,000 account receivable

Q40: Ralph purchased his first Series EE bond

Q51: Susan purchased an annuity for $120,000.She is

Q65: Bhaskar purchased a new factory building on

Q78: Norm purchases a new sports utility vehicle

Q137: Amy works as an auditor for a