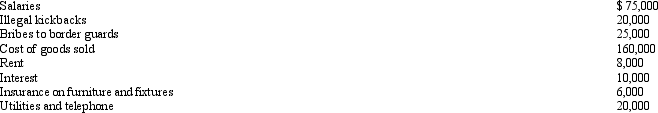

Tom operates an illegal drug-running operation and incurred the following expenses:  Which of the above amounts reduces his taxable income?

Which of the above amounts reduces his taxable income?

Definitions:

Corporate Tax Rates

The percentages of corporate profits that businesses must pay to the government as taxes.

Means-tested

Pertaining to government programs that require individuals to meet certain income or asset criteria to qualify for benefits.

State Sales Tax

A tax imposed by a state on the sale of goods and services, typically calculated as a percentage of the selling price.

Inheritance Tax

A tax imposed on individuals who inherit assets from a deceased person.

Q16: Members of a research team can exclude

Q20: In which,if any,of the following situations may

Q22: Martha drove 200 miles to volunteer in

Q40: During the year,Victor spent $300 on bingo

Q45: Which of the following is not deductible?<br>A)Moving

Q69: If the alimony recapture rules apply,the recipient

Q72: Taxpayers may elect to use the straight-line

Q82: On January 1,Father (Dave)loaned Daughter (Debra)$100,000 to

Q86: A taxpayer who lives and works in

Q92: The statutory dollar cost recovery limits under