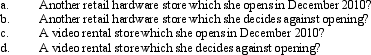

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2010 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2010 if the business is:

Definitions:

Economic Colony

A region or country under the economic control or influence of another, often exploited for its resources.

Prime Exporter

A country or firm that is the leading seller of goods or services to foreign countries, thereby holding a significant share of international trade in certain commodities or products.

Trade Surplus

A situation where a country exports more goods and services than it imports, leading to a positive balance of trade.

Tariffs

Taxes imposed on imported goods, often used to protect domestic industries from foreign competition.

Q14: Ellen,age 39 and single,furnishes more than 50%

Q18: All expenses associated with the production of

Q32: Assuming an activity is deemed to be

Q64: Green,Inc. ,provides group term life insurance for

Q77: All employees of United Company are covered

Q94: Nicholas owned stock that decreased in value

Q98: Shirley pays FICA (employer's share)on the wages

Q101: In 2010,Ed is 66 and single.If he

Q107: Robyn rents her beach house for 60

Q112: There is reason to believe that many