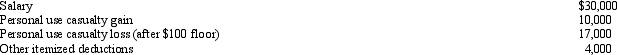

In 2010,Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Definitions:

Unemployment Relief

Government programs or measures designed to provide financial aid or jobs to individuals who are unemployed.

Surplus Food

Food production that exceeds the immediate consumption needs of the population, which can be stored or distributed as needed.

Joblessness

The state of being without employment, often measured as an unemployment rate within an economy.

Bonus Expeditionary Force

A group of World War I veterans who marched on Washington D.C. in 1932 to demand early payment of a promised bonus.

Q17: Robert had the following transactions for 2010:<br>

Q19: On a particular Saturday,Tom had planned to

Q45: Grace's sole source of income is from

Q58: A business bad debt can offset an

Q75: In terms of income tax treatment,what is

Q88: If the amount of the insurance recovery

Q97: Gold Company was experiencing financial difficulties,but was

Q100: In his will,John named his nephew Steve

Q132: After graduating from college,Dylan obtained employment in

Q145: An education expense deduction can be allowed