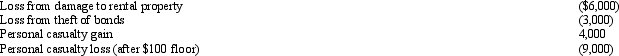

In 2010,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Subsurface Rights

Legal rights to use and exploit the area beneath the surface of a piece of land, including the rights to extract minerals, oil, and gas.

Pass Title

The transfer of ownership rights of a property or asset from one party to another, typically through a legal document or deed.

Subsurface Rights

Legal rights to the minerals, oil, gas, and other resources located below the surface of a piece of property.

Surface Subsides

The phenomenon of ground levels sinking or settling, which can result from natural processes or human activities such as mining or excessive groundwater extraction.

Q2: Joyce,an attorney,earns $100,000 from her law practice

Q6: On July 10,2010,Ariff places in service a

Q8: Olaf was injured in an automobile accident

Q15: Some transactions can qualify as either business

Q22: Dick participates in an activity for 90

Q49: Alma is in the business of dairy

Q66: Terri purchased an annuity for $100,000.She was

Q85: Expenses in connection with the acquisition of

Q91: Tony is married and files a joint

Q98: Sarah,a majority shareholder in Teal,Inc. ,received a