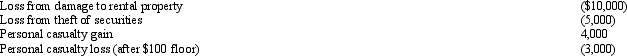

In 2010,Theo had a salary of $30,000 and experienced the following losses:  Determine the amount of Theo's itemized deduction from these losses.

Determine the amount of Theo's itemized deduction from these losses.

Definitions:

Dividends Declared

A formal announcement by a company's board of directors to distribute a portion of the company’s earnings to shareholders.

Dividend Income

Income earned by investors from receiving dividends, which are distributed portions of a company's profit.

Non-Controlling Interest

The portion of equity in a subsidiary not attributable, directly or indirectly, to the parent company, reflecting the minority shareholder's stake in the subsidiary’s net assets.

Entity Method

A valuation approach in business combination accounting that views the acquiring and target company as a single entity from the date of acquisition.

Q26: Lois,who is single,received $9,000 of Social Security

Q38: In 2010,Joanne invested $90,000 for a 20%

Q42: Mike contracted with Kram Company,Mike's controlled corporation.Mike

Q57: If more than 40% of the value

Q65: In December 2010,Emily,a cash basis taxpayer,received a

Q77: David,a single taxpayer,took out a mortgage on

Q91: The alimony rules:<br>A)Are based on the principle

Q101: The portion of the office in the

Q102: If a scholarship does not satisfy the

Q123: Which,if any,of the following expenses are not