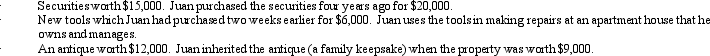

In 2010,Juan's home was burglarized.Juan had the following items stolen:  Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $60,000,determine the amount of his itemized deductions as a result of the theft.

Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $60,000,determine the amount of his itemized deductions as a result of the theft.

Definitions:

Bad Debt

A receivable that is considered irrecoverable and is therefore written off as a loss.

Incremental Cost

The additional cost associated with producing one additional unit of output.

Carrying Receivables

The accounting practice of recognizing unpaid invoices as assets on a company's balance sheet, expected to be converted into cash within a year.

Economic Ordering Quantity

The optimal number of units to order to minimize the total costs associated with buying, delivering, and storing inventory.

Q3: The maximum annual contribution to a Roth

Q9: Early in the year,Marcus was in an

Q11: Briefly discuss the two tests that an

Q20: Which of the following is not a

Q21: Denny was neither bankrupt nor insolvent but

Q32: Peggy is an executive for the Tan

Q72: The taxable portion of Social Security benefits

Q74: For a person who is in the

Q77: David,a single taxpayer,took out a mortgage on

Q85: Only certain employment related expenses are classified