In 2009,Robin Corporation Incurred the Following Expenditures in Connection with the Development

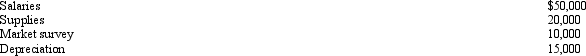

In 2009,Robin Corporation incurred the following expenditures in connection with the development of a new product:

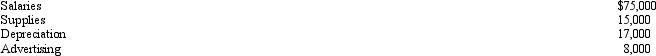

In 2010,Robin incurred the following additional expenditures in connection with the development of the product:

In 2010,Robin incurred the following additional expenditures in connection with the development of the product:

In October 2010,Robin began receiving benefits from the project.If Robin elects to expense research and experimental expenditures,determine the amount and year of the deduction.

In October 2010,Robin began receiving benefits from the project.If Robin elects to expense research and experimental expenditures,determine the amount and year of the deduction.

Deductibility of research and experimental expenditures is permitted in the year of incurrence.

Definitions:

Social network

A structure made up of a set of actors (such as individuals or organizations) and the dyadic ties between these actors.

Anonymous

Not identified by name or remaining unknown in identity.

Left-handed people

Individuals who predominantly use their left hand for activities such as writing and handling tools, comprising a minority of the population.

Category

People who share one or more attributes but who lack a sense of common identity or belonging.

Q2: Joyce,an attorney,earns $100,000 from her law practice

Q21: In 2010,Jimmy,a cash basis taxpayer,was offered $3,000,000

Q34: A farming NOL may be carried back

Q55: John files a return as a single

Q59: From January through November,Vern participated for 420

Q64: The purpose of the work opportunity tax

Q84: On October 1,2010,Bob,a cash basis taxpayer,gave Dave

Q112: As an executive of Cherry,Inc. ,Ollie receives

Q115: Heather is a full-time employee of the

Q117: Arnold was employed during the first six