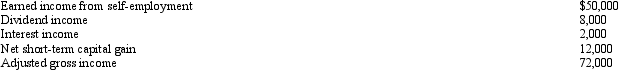

Susan is a self-employed accountant with a qualified defined contribution plan (a Keogh plan) .She has the following income items for the year:  What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2010,assuming the self-employment tax rate is 15.3%?

What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2010,assuming the self-employment tax rate is 15.3%?

Definitions:

Customers Served

The number of customers a business or service has provided for or sold to during a specific period, indicating the reach or impact of the business.

Revenue Formulas

Mathematical equations or models used to calculate the total income generated from sales of goods or services before any costs or expenses are deducted.

Patient-visits

An instance of a patient seeking medical services, often used in healthcare management to track and evaluate service demand and capacity planning.

Planning Budget

A financial plan that estimates future income, expenditures, and resources over a specific period, often used for setting performance benchmarks.

Q1: In the case of a fringe benefit

Q10: Maria,who owns a 50% interest in a

Q16: Under MACRS,if the mid-quarter convention is applicable,all

Q30: Letha incurred a $1,600 prepayment penalty to

Q47: Contributions to a Roth IRA can be

Q64: If a taxpayer has an NOL in

Q78: Bob sold a personal residence to Fred

Q85: Expenses in connection with the acquisition of

Q116: Bridgett's son,Amos,is $4,500 in arrears on his

Q157: This year,Fran receives a birthday gift of