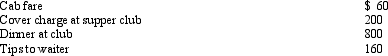

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation,Henry's deduction is:

Presuming proper substantiation,Henry's deduction is:

Definitions:

Divergent Thinking

A thought process or method used to generate creative ideas by exploring many possible solutions.

Task Conflict

A disagreement or dispute among team members related to the content and outcomes of the tasks being performed.

Relationship Conflict

Interpersonal discord arising from differences in values, personalities, or interests among members of a group or team.

Process Conflict

involves disagreements about the methodology or process of work execution, differing from content conflict which relates to the work itself.

Q2: The cost of a covenant not to

Q3: Pat purchased a used five-year class asset

Q20: Kate sells property for $120,000.The buyer pays

Q28: A taxpayer who claims the standard deduction

Q30: In choosing between the actual expense method

Q39: The disabled access credit was enacted to

Q68: Kim dies owning a passive activity with

Q75: Are there any exceptions to the rule

Q78: In 2010,Khalid was in an automobile accident

Q104: In March 2010,Gray Corporation hired two individuals,both