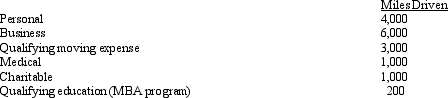

Gus uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2010,his mileage was as follows:

How much can Gus claim for mileage?

How much can Gus claim for mileage?

Definitions:

Kübler-Ross's Model

A theory that outlines five stages of grief that individuals go through when faced with terminal illness or catastrophic loss, including denial, anger, bargaining, depression, and acceptance.

Therapeutic Recommendations

Advice or guidelines provided by healthcare professionals to patients for the treatment of physical, mental, or emotional conditions, aimed at improving health outcomes.

Symbolic Interactionism

A sociological perspective focusing on the role of symbols and language as core elements of all human interaction.

Cultural Capital

The non-financial social assets, like education, intellect, style of speech, or dress, that promote social mobility.

Q1: Freda,who has AGI of $100,000 in 2010,contributes

Q19: Which,if any,of the following expenses is subject

Q34: Roberto,a self-employed patent attorney,flew from his home

Q35: Sid bought a new $700,000 seven-year class

Q45: In May 2006,Alma incurred qualifying rehabilitation expenditures

Q54: During the year,Walt went from Louisville to

Q63: In contrasting the reporting procedures of employees

Q92: The holding period for property acquired by

Q94: For self-employed taxpayers,travel expenses are not subject

Q141: After the automatic mileage rate has been