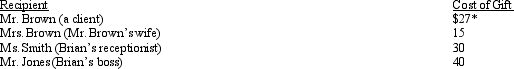

Brian makes gifts as follows:

* Includes $2 for engraving

* Includes $2 for engraving

Presuming adequate substantiation and no reimbursement,how much may Brian deduct?

Definitions:

New Nurse

A term for a registered nurse who has recently graduated and is new to the nursing profession, often requiring additional support and orientation.

Critical Thinking Attitude

An approach to problem-solving that involves questioning assumptions and carefully evaluating evidence to guide decision making.

Display

A device or mechanism designed to visually present information, such as a computer monitor, smartphone screen, or digital signage.

Asking

The act of requesting information, clarification, or action from another person.

Q4: Pat generated self-employment income in 2010 of

Q8: In 2009,Kelly,who earns a salary of $200,000,invests

Q11: If a taxpayer uses regular MACRS for

Q20: Which of the following events would produce

Q52: Susan is a self-employed accountant with a

Q58: Identify how the passive loss rules broadly

Q96: During 2010,Eleanor earns $146,000 in wages as

Q99: The American Opportunity credit is available per

Q119: Amanda takes three key clients to a

Q130: A baseball team that pays a star